- Author:MQH

- 2023-03-03 17:00

- Published in Jiangsu

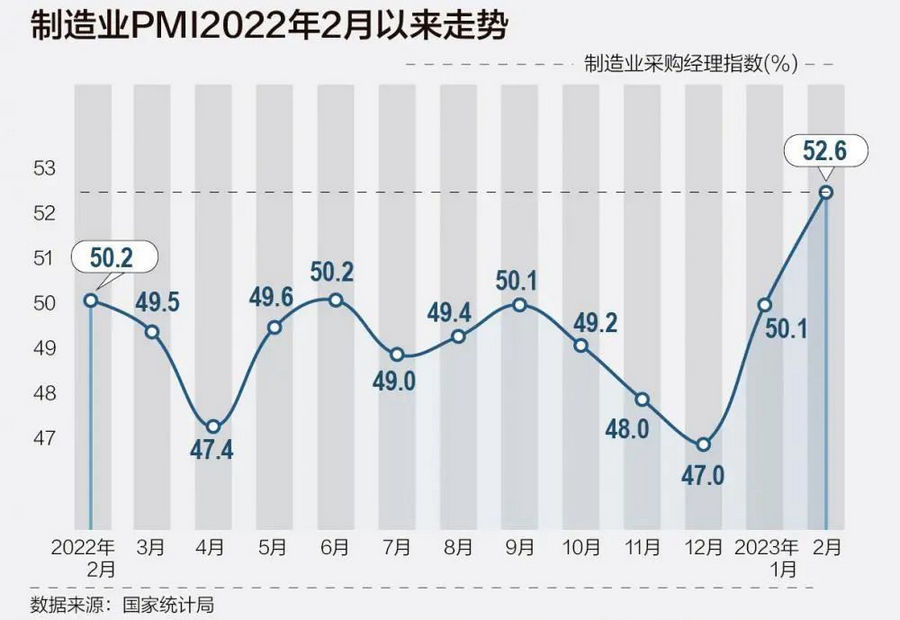

On March 1, data released by the National Bureau of Statistics showed that China's manufacturing purchasing managers' index (PMI) continued to rise to 52.6% in February, up 2.5 percentage points from the previous month, and hit a new high since May 2012. From the point of view of 13 sub-indexes, compared with the previous month, each sub-index rose in February, the increase is between 0.2 and 6.9 percentage points.

Experts surveyed said that after the Spring Festival holiday and the peak of the epidemic, China is in the stage of resuming work and production, resuming business and resuming the market, and economic activities will recover quickly, and market expectations will also increase. However, the problem of insufficient market demand is still prominent, and the foundation of China's economic recovery needs to be consolidated, and the subsequent trend of the purchasing managers' index remains to be further observed.

The release of demand led to the expansion of production. After entering February, the impact of the novel coronavirus infection epidemic across the country basically subsided, social mobility fully recovered after the Spring Festival, and the demand for the manufacturing market rebounded rapidly. Data from the National Bureau of Statistics showed that the new orders index in February was 54.1%, up 3.2 percentage points from the previous month.

Wen Tao, an analyst at the China Logistics Information Center, said that external demand is also showing obvious signs of recovery, the new export orders index was 52.4%, up 6.3 percentage points from the previous month, and returned to more than 50% after running in the contraction range for 21 consecutive months, showing that the global economic downturn has eased and the stable foreign trade policy has continued to exert force. Driven by many factors such as domestic enterprises' efforts to enhance competitiveness, China's exports have stopped falling and stabilized. Moreover, the recovery of demand injected impetus into enterprise production, the recovery of social liquidity provided guarantee for production activities, and the production base of enterprises further improved.

According to the National Bureau of Statistics, enterprise production is now expanding rapidly, and the production index returned to expansion territory in February, up 6.9 percentage points from the previous month to 56.7%.

Wu Chaoming, vice president of the Caixin Research Institute, told the 21st Century Business Herald that the recovery of the production index in February was much higher than the new orders index, and the difference between the manufacturing "production and new orders index" increased from -1.1% last month to 2.6%, and the gap between supply and demand rose to a high range. However, as the volatility caused by the epidemic tends to weaken and the steady growth policy is further implemented, the repair of domestic demand will become the main logic of economic operation, and the future gap between supply and demand is expected to operate at a low level.

With the accelerated release of production and demand, enterprise procurement activities and recruitment activities have also increased significantly. In February, the purchasing index was 53.5%, up 3.1 percentage points from the previous month, and the import index was 51.3%, up 4.6 percentage points from the previous month, returning to the expansion range after running below 50% for 20 consecutive months. The employment index was 50.2% in February, up 2.5 percentage points from the previous month, returning to expansion territory after 22 consecutive months of running below 50%.

Zhou Maohua, a macro researcher in the financial markets department of Everbright Bank, told the 21st Century Business Herald that at present, enterprises are increasing the purchase of raw materials, and enterprises are expected to turn optimistic about the prospects for economic recovery. From the inventory index of industrial finished products, the overall inventory of domestic industry has also fallen to near the historical average, and the willingness to actively replenish inventory and expand production has increased. The increase in the number of employees also helps to ensure the good development of basic people's livelihood, thus laying the foundation for the subsequent stability of the consumer market.

However, driven by the market recovery, the overall level of manufacturing raw material purchase prices continued to rise, the main raw material purchase price index rose to 54.4%, 2.2 percentage points higher than last month, of which steel and related downstream industries rose more significantly. The purchase price index of major raw materials in ferrous metal smelting and rolling processing, general equipment, special equipment and other industries was higher than 60.0%. The ex-factory price index was 51.2%, 2.5 percentage points higher than the previous month, returning to the expansion range, and the overall level of sales prices of manufacturing products has recovered.

Wu Chaoming analysis, factory prices rose above the critical value, and the recovery rate is slightly higher than the purchase price of raw materials, showing that with the recovery of demand, middle and downstream factory prices have fallen, facing cost pressures tend to weaken, is expected in February industrial producer price index PPI month-on-month growth or will turn positive, while the year-on-year growth rate is probably maintained at -1.2%.

Smes are back in expansion territory

It is worth noting that this economic recovery has reflected the good, and the vitality of various enterprises has rebounded significantly. Among them, the PMI of medium-sized enterprises and small enterprises were 52% and 51.2%, respectively, up 3.4 and 4 percentage points from the previous month, and they returned to the expansion range after running below 50% for many consecutive months, showing that the continuous downward trend of small and medium-sized enterprises has reversed.

Wu Chaoming said that small and medium-sized enterprises were more seriously affected by the epidemic in the early stage, and the PMI of small and medium-sized enterprises picked up more than that of large enterprises in February, and the prosperity differentiation of enterprises of different sizes tended to narrow. New export orders ended 21 consecutive months of contraction in February, mainly due to the recovery of economic activity among small businesses, which turned a drag on aggregate domestic demand into a support. However, small and medium-sized enterprises are still the weak link in the current economic recovery, and further support needs to be increased in the future.

At the same time, the upstream and downstream of the industrial chain have also significantly recovered. At present, 18 out of 21 industries surveyed by the National Bureau of Statistics are in the expansion range, an increase of seven from the previous month, and the manufacturing industry continues to expand. Among them, the PMI of the equipment manufacturing industry, high-tech manufacturing industry, high energy consumption industry and consumer goods industry were 54.5%, 53.6%, 51.6% and 51.3%, higher than the previous month 3.8, 1.1, 3.0 and 0.4 percentage points, all located in the expansion range, and the prosperity level has risen for two consecutive months.

Wu Chaoming analysis, high-tech manufacturing and equipment manufacturing industry benefit from the accelerated release of technological transformation demand, the boom continues to rebound, the support for manufacturing demand is strong; High energy-consuming industries are affected by the effects of stable growth policies and the recovery of real estate consumption, and the prosperity has also rebounded significantly. The consumer goods manufacturing industry was affected by the decrease in demand after the holiday, and the recovery rate was low, but it continued to expand and accelerate.

However, Zhang Liqun, special analyst of the China Federation of Logistics and Purchasing, reminded that the proportion of enterprises reflecting insufficient market demand in the current survey is still more than 52%, and the proportion of enterprises reflecting high raw material costs is still more than 49%, indicating that the difficulties faced by enterprises in production and operation are still not small. In the future, we will further strengthen the implementation of various tasks such as expanding domestic demand, ensuring supply and stabilizing prices, and relentlessly consolidating the foundation for economic recovery.

Wen Tao also pointed out that the current market demand recovery has structural problems. Among them, the external demand of high-tech manufacturing and consumer goods manufacturing industry rose rapidly in February, but the growth rate of domestic demand slowed down in the same period, showing that the domestic market terminal consumption needs to be further released.

"The next impact on manufacturing is likely to focus on three areas: overseas demand, the pace of the housing recovery and car sales." Zhou Maohua analysis, the current PMI index of major overseas economies have slowed to the contraction area, but the recent economic recession in Europe and the United States is mild, and China's foreign trade exports are still expected to maintain moderate growth. Moreover, domestic real estate prices have ended 11 months of continuous contraction, first-line and second-line relatively rapid recovery, and the drag of the property market on domestic demand weakened in the first half of the year. The pull of the automobile on the manufacturing industry is obvious, but under the impact of the cancellation of some favorable policies, the subsequent impact on the manufacturing industry remains to be seen. However, on the whole, residential consumption will continue to repair the momentum, infrastructure investment to maintain rapid growth, coupled with the steady growth policy continues to exert force, the manufacturing industry boom will continue to run in the expansion range in the short term.

中文

中文 Feat

Feat

Consult

Consult Help

Help